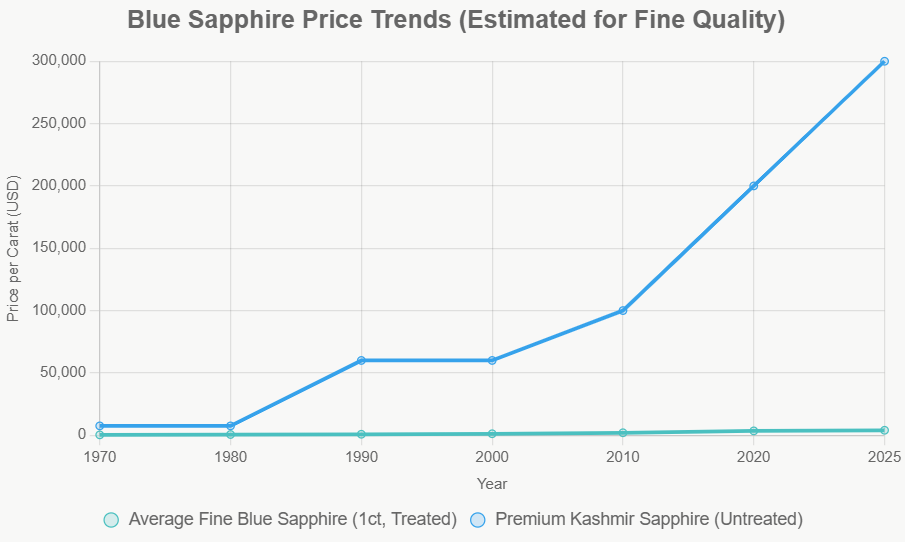

The Evolution of Blue Sapphire Prices : A Historical Analysis from 1970 to 2025

Blue sapphires are well-known for their rich, velvety shades and exceptional hardness has long been a foundation of the gem market. As one of the “Big Three” colored gemstones along with rubies and emeralds, blue sapphires have seen notable price appreciation over the decades, This rise has been driven by limited supply, technological advancements in treatments, shifting mining landscapes, and rising demand from collectors, jewelers, and investors. This article explores the historical price trends of blue sapphires from 1970 to the present day (as of December 31, 2025), portraying on data from trusted sources like auction records from Christie’s and Sotheby’s, market examines from gemological experts, and historical studies. Values are typically quoted per carat and vary significantly depending on quality features, origin, and treatment, with untreated stones from Kashmir and Burma (Myanmar) commanding the highest premiums

Due to market variability, we can keep up trends using data for fine-quality stones (e.g., vivid blue color with good clarity), exact average prices for all blue sapphires are challenging. For context, “fine quality” here implies eye-clean, well-cut stones without significant inclusions that reduce from value. Top examples, such as untreated Kashmir sapphires, often serve as benchmarks for the upper end of the market.

Heat Treatment Revolution and Increased Supply: The 1970s

The 1970s characterized a essential era for the blue sapphire market, largely due to the general consent of heat treatment techniques in Thailand. This process, which enhances color by dissolving inclusions and increasing blue hues, substantially increased the supply of profitable stones from sources like Sri Lanka (then Ceylon) and Australia. Prior to this, many sapphires were pale or milky and unfitting for fine jewelry.

- Price for 1-Carat: Treated blue sapphires from common sources ranged from approximately $100 to $500 per carat for good commercial quality, while untreated quality stones from Kashmir or Burma could reach $5,000 to $10,000 per carat.

- Key Factors: The influx of treated stones from Thai facilities made blue sapphires more accessible, steadying lower-end prices but creating a premium for untreated gems. Auction data from this era is thin, but one remarkable example is the re cutting of the Rockefeller Sapphire (a 62.02-carat Burmese stone) in the early 1970s.

- Trend: Prices remained relatively undefined compared to later decades, with overall jewelry increase contributing to steady increases.

The 1980s: Rising Demand and Market Development

Blue sapphires gained popularity in fine jewelry, By the 1980s, powered by celebrity permissions (e.g., Princess Diana’s sapphire engagement ring in 1981) and a thriving global economy. Demand for colored gemstones hurried, surpassing supply and leading the prices to increase. Heat treatment became standard, but judgment grew for origin and treatment encounter.

- Price for 1-Carat: Commercial treated sapphires rose to $500 to $2,000 per carat, with premium untreated Kashmir or Burmese examples reaching $5,000 to $10,000 per carat early in the time and rising higher by the end.

- Key Factors: Political volatility in mining regions like Myanmar limited new finds, while auction houses like Christie’s and Sotheby’s began documenting sales more thoroughly. An instructive tale from 1987 involved a large star sapphire valued at $2.85 million, emphasizing the era’s positivity but also unpredictability.

- Trend: Prices appreciated gradually, with fine gems showing 20-50% increases over the decade due to keen consumer interest and limited premium-quality supply.

The 1990s: Certification and Premium Distinction

Market transparency increased considerably in the 1990s with the widespread approval of gemological certifications from institutions including GIA and SSEF. Clearer identification of treated against untreated stones led to widening price differentials. At the same time, new sources such as Madagascar expanded supply, though stones from top-tier origins continued scarce.

- Price for 1-Carat: By 1995, treated blue sapphires from sources like Sri Lanka or Australia are typically traded $225 to $700 per carat for good to excellent quality. Larger stones (5+ carats) in exceptional quality could exceed $15,000 to $45,000 per carat for superior origins.

- Key Factors: The decade saw auction records begin to launch clear benchmarks, with the Rockefeller Sapphire setting standards (later sold for $3,031,000 in 2001, or round $48,887 per carat). Historical studies, such as those by Sydney H. Ball, noted long-term price growths driven by scarcity.

- Trend: Prices for premium untreated sapphires surged to $40,000-$80,000 per carat by the late 1990s, replicating a 4-8x increase from the 1970s for the maximum quality stones.

The 2000s: Globalization and New sources

Image Credit : Airalondon.com

However mainly in Asia, demand for investment-grade stones grew as The early 2000s carried globalization to the gem trade, with increased mining in Madagascar engulfing the market with reasonable treated sapphires.

- Price for 1-Carat: Treated commercial sapphires steadied at $500 to $1,500 per carat, while premium untreated examples goes up to $10,000 to $50,000 per carat.

- Key Factors: Gemval’s historical record trails steady gratitude, though specific figures highlight color differences. Auctions highlighted rarity, with a 95.45-carat pink sapphire selling for $2.3 million in 2008.

Trend: Overall market growth at 5-7% annually.

The 2010s: Rapid Appreciation and Auction Records

In 2010 there was a large demand and appreciation for blue sapphires.

- Price for 1-Carat: By mid-decade, good treated sapphires reached $800 to $3,000 per carat, with premium untreated stones were high up to $50,000 to $100,000 per carat.

- Key Factors: sapphire values increased by approximately 250%, turning a €11,309 asset into €39,583, from 2013 to 2023. Landmark sales included the Blue Belle of Asia (392.52 carats) at $17.3 million in 2014 ($44,000 per carat)

- Trend: Annual increases of 6-8.

The 2020s: Constant Growth and Record Highs

As of 2025, blue sapphire prices continue their upward path, strengthened by luxury demand and it being limited supply.

- Price for 1-Carat: Commercial treated sapphires range from $1,000 to $5,000 per carat; while premium untreated Kashmir examples can go beyond $100,000 to $500,000+ per carat.

- Trend: Constant 6-8% annual growth, with high-end stones outdoing due to rarity and investment appeal

- Key Factors: Natural blue sapphires over 5 carats saw a 12% price increase in 2025 alone. Auctions crushed records, such as an 8.18-carat Kashmir sapphire ring at $5.1 million ($623,000 per carat) and the 35.09-carat Regent Kashmir sapphire at $9.5 million ($271,000 per carat).

Factors Driving Prices to go up

Several features have contributed to the overall upward trend:

- Supply Limitations: Collapse of historic mines (e.g., Kashmir deposits closed since the 1930s) and disturbances in Myanmar and Sri Lanka.

- Demand Growth: Rising wealth in Asia, celebrity influence, and investment divergence.

- Treatments and Certification: Untreated stones premium-priced; GIA reports add value.

- Economic Factors: Increase, currency fluctuations, and a 6-8% annual complex growth rate.

Conclusion

Blue sapphire prices have scaled abruptly from the 1970s to 2025, increasing 10–20× for top-tier stones and 5–10× for commercial quality. Limited supply and increasing demand continue to support their investment application. Collectors are best served by centering on certified, untreated sapphires from upright origins and referencing GIA reports or auction data for up-to-date pricing.